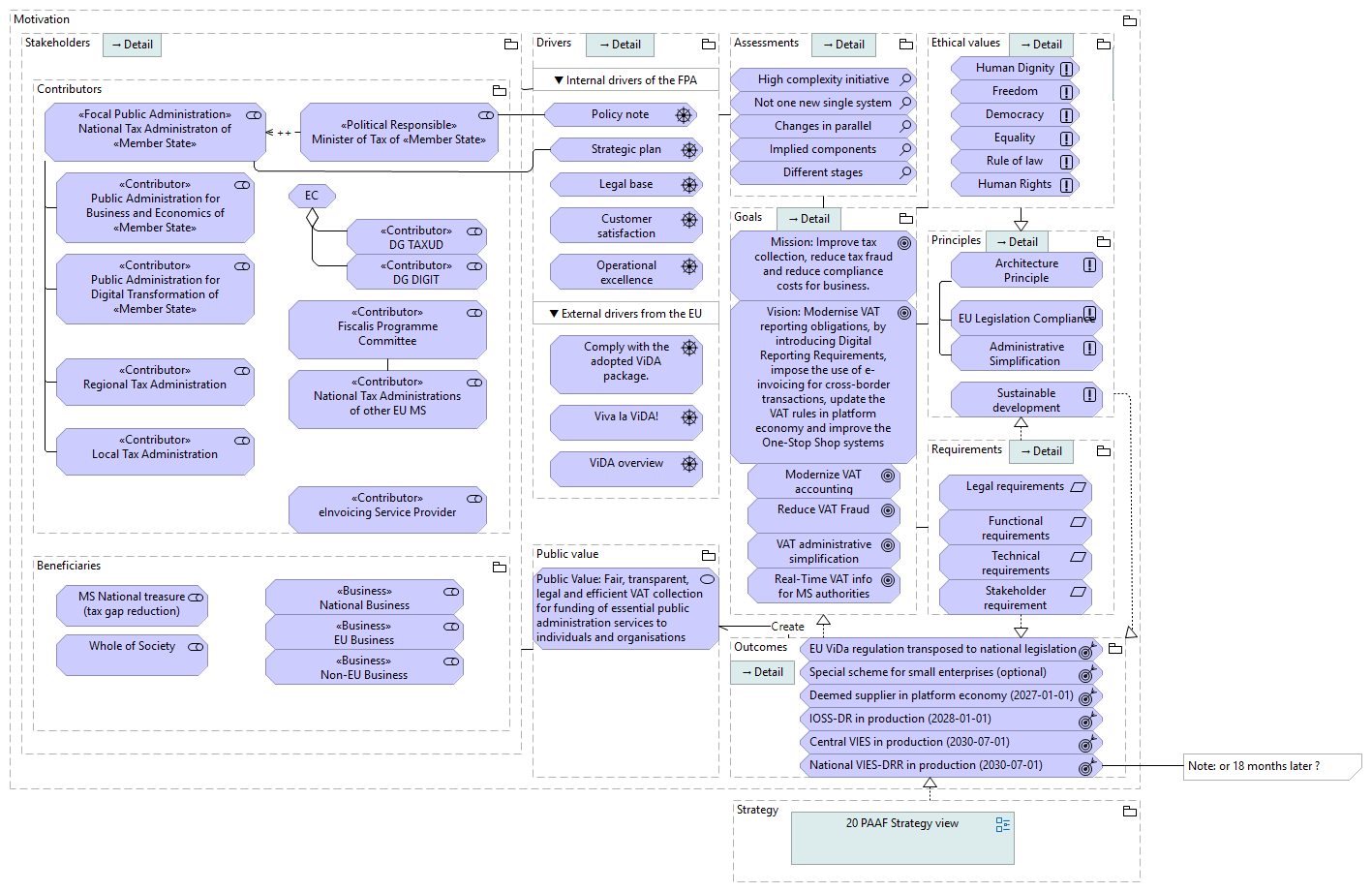

Description: The "Motivation" view in the KU Leuven PAAF RA groups the most salient motivation elements of the Enterprise Architecture of the Focal Public Administration.

Narrative:

The [Motivation] view contains: the [Motivation] grouping element.

The "Motivation" grouping ABB in the KU Leuven PAAF RA groups the most salient motivation elements of the Enterprise Architecture of the [Focal Public Administration].

It contains several subgroupings that group a number of elements that are of the same type.

Those are : [Stakeholders], [Drivers], [Assessments], [Goals], [Ethical values], [Principles], [Requirements], [Outcomes] and [Public value].

Each of these groupings are described below. The relationships between these groupings are the standard relationships between the ABB that are proposed by the KU Leuven Public Administration Reference Architecture (PAAF RA).

The [Stakeholders] grouping ABB contains the most relevant stakeholders of the [Focal Public Administration].

These can either be beneficiaries, i.e. persons or legal entities that make use of the services of the [Focal Public Administration] or have some kind of public value realisation by the [Focal Public Administration], or they can be contributors, i.e. persons or legal entities that help the [Focal Public Administration] to deliver their services (e.g. by providing data or information).

The stakeholders can be [Individuals], [Enterprises], other [Public administrations], or (not for profit) [Organisations].

The [Focal Public Administration] and the [Political responsible] of the [Focal Public Administration] are also considered as stakeholders. Noteably, the staff of the [Focal Public Administration] typically plays a very important role in the execution of the strategy and the delivery of the services of the [Focal Public Administration].

The [Drivers] subgroup of the motivation grouping contains the different elements that explain why the [Focal Public Administration] exists.

This group aggregates elements of legal compliance like the [Legal base] that includes the law or legal instrument that created the [Focal Public Administration] and the laws or legal instruments that define their statutory mission and mandate. Other drivers may include the [Policy note] of the [Political responsible] of the [Focal Public Administration], the [Strategic plan] of the [Focal Public Administration] itself, or drivers like [Customer satisfaction], [Operational excellence] etc.

Because the legal base of Public Adminstrations is a key component of providing proof to the public that the workings of the [Focal Public Administration] are in compliance with the rule of law, it is advisable to make use of the separate 'architecture detail view' that is included in this RA model for this purpose. A view reference to this view is included in the [Legal base] driver.

The process of defining Strategic [Goals] for the [Focal Public Administration] includes making assessments that are documented in the [Assessments] subgroup.

An Assessment represents the result of an analysis of the state of affairs of the [Focal Public Administration] with respect to some [Driver].

A view reference to a separate [Architecture detail view] for [Assessments] is included to allow to docment those in detail.

The [Goals] subgroup of the motivation grouping aggregates the [Mission] statement, the [Vision] and the most important strategic goals.

Strategic goals are modelled as a EIRA [Public Policy Objective] (http://data.europa.eu/dr8/PublicPolicyObjectiveGoal) ABB.

A view reference is provided to a PAAF architecture detail [Goals view], where the complete set of goals of the [Focal Public Administration] can be detailed, together with the breakdown in subgoals and operational goals.

The [Ethical values] subgroup of the [Motivation] grouping contains the most important Ethical values of the [Focal Public Administration]. They are modeled as principles, because they are guidelines that hold true for all operations of the [Focal Public Administration].

The [Principles] subgrouping of the [Motivation] grouping contains the principles that are to be applied at organisation level in the [Focal Public Administration]. They help to realise the [Outcomes].

A principle defines a general property that applies to any system in a certain context, whereas a requirement defines a property that applies to a specific system as described by an architecture.

A suggested principle to consider for all Public Administrations is to take into consideration systematically the [Sustainable development] goals of the United Nations.

The [Architecture Principle] EIRA ABB has been included here as basis.

The [Requirements] subgrouping of the [Motivation] grouping contains the requirements and constraints that are to be applied at organisation level in the [Focal Public Administration]. They help to realise the [Outcomes].

A requirement defines a property that applies to a specific system as described by an architecture.

The [Public Policy Context] and [Digital Solution Requirement] EIRA ABB have been included here as examples that may be included in the enterprise architecture of the [Focal Public Administration].

The [Outcomes] subgrouping of the [Motivation] grouping contains the [Outcomes] that are realised by the [Focal Public Administration].

The [Outcomes] are realised by applying the [Requirements] (potentially regulated by some [Constraints] and the [Principles] that are specified in the [Desired properties] subgroup.

[Outcomes], on their turn, realise the [Strategic goals] of the [Focal Public Administration], and in this way create the [Public Value] for the [Stakeholders].

On a strategic level, outcomes are realised as a result of a [Public policy], i.e. a management decision to create or improve a value creating public administration service. This [Public policy] in its turn is realised by deploying a [Business capability].

The [Public value] subgrouping of the [Movtivation] grouping contains the [Public Value] ABB(s) that contains statements about the specific value the [Focal Public Administration] creates for one or more of their [Stakeholders].

This value is created by one or more [Outcomes]. Different [Stakeholders] may attach a different [Public value] to [Outcomes], since they may have different interests.

The relations between the different elements in the subgrouping of the [Motivation] grouping are defined between the different subgroupings. The semantics of grouping imply that a relationship from or to a group should be interpreted as a collective relationship with the group’s contents. Using this notation, the following relations are defined in the [Motivation] grouping.

The [Stakeholders] have an association with the [Drivers]. The semantics of this are that the [Focal Public Administration] and their [Political responsible] are motivated by the [Drivers] to define their goals and implement the changes necessary to achieve them. A second meaning of this association is that the other stakeholders, [Individuals], [Enterprises], other [Public administrations], or (not for profit) [Organisations], in their role of benficiaries of the services of the [Focal Public Administration] have needs and expectations, that are reflected in the [Drivers].

The [Drivers] have an association relationship with the [Assessments]. This reflects the fact that an Assessment represents the result of an analysis of the state of affairs of the [Focal Public Administration] with respect to some [Driver].

The [Assessments] have an association relationship with the [Goals], because it is through the process of the analysis in the assessments that the [Focal Public Administration] will define their [Mission], [Vision] and strategic [Goals].

The [Goals] have several other associations. The first one is with the [Ethical Values] of the [Focal Public Administration], because those are closely associated with the [Mission] and the [Vision].

The second and third one are with the [Principles] and [Requirements] that have to be applied when pursuing the strategic [Goals] of the organisation.

Note also that [Ethical values] are modeled as a specialisation of [Principles].

[Principles] have a realise relationship with [Outcomes].

[Requirements] also have a realise relationship with [Outcomes].

Moreover, [Requirements] may have a realise relationship with [Principles].

[Outcomes], on their turn, have a realise relationship with the [Strategic goals] of the [Focal Public Administration], and are associated with (create) the [Public Value] for the [Stakeholders].

On a strategic level, outcomes are realised as a result of a [Public policy], i.e. a management decision to create or improve a value creating public administration service. This [Public policy] in its turn is realised by deploying a [Business capability].

The [Public value], to conclude with, has an association with the [Stakeholders] that is (again) twofold : the [Public value] is created by the [Focal Public Administration], sometimes assisted by other stakeholder, while the other stakeholder can be the beneficiaries of the created [Public value].

To conclude this narrative: all subgroupings have a aggregates relationship with the elements they contain, and all groupings have an aggregates relationship with the subgroups they contain and therefore also with the elements that are contained within the subgroups.