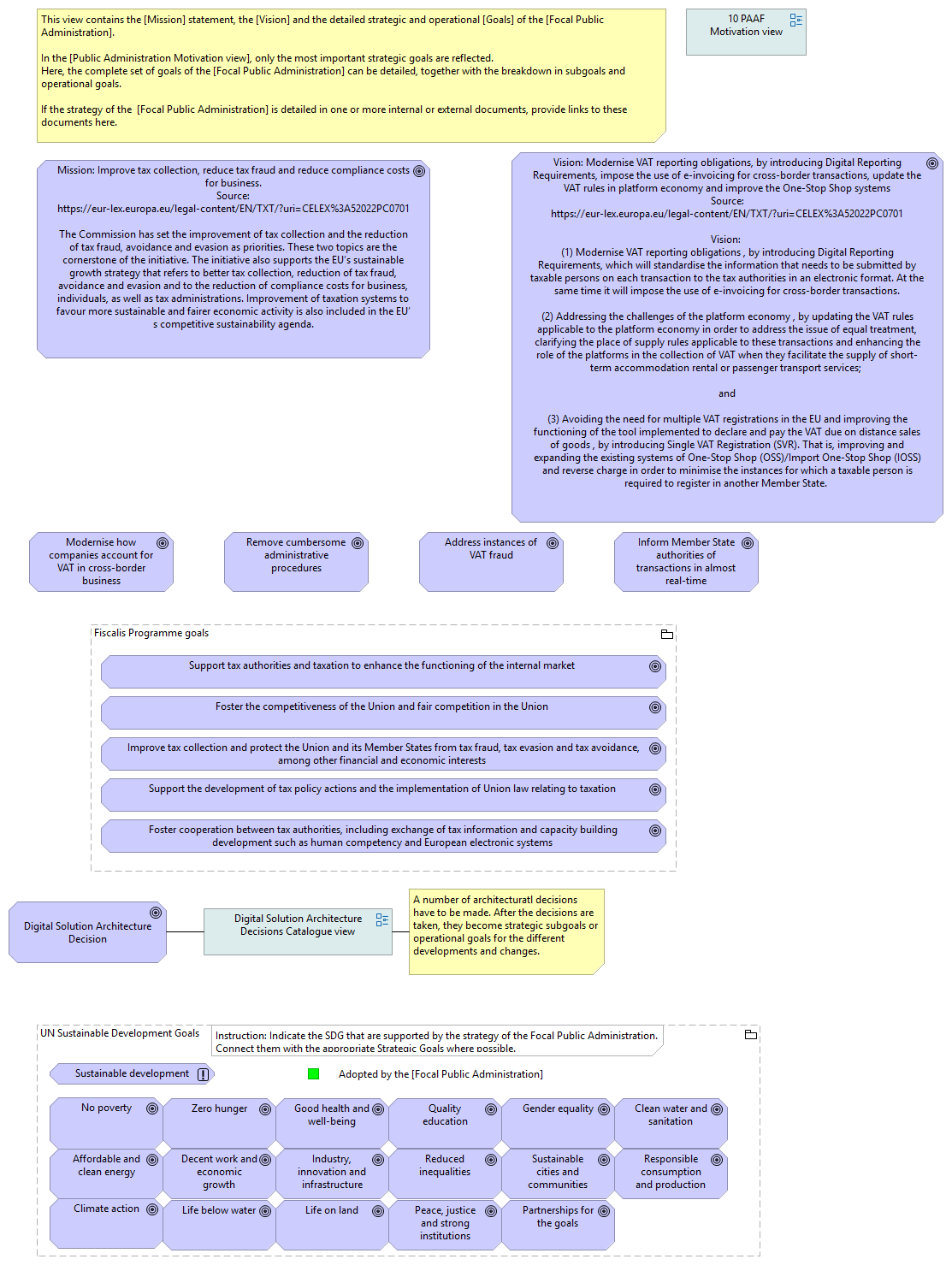

This view contains the [Mission] statement, the [Vision] and the detailed strategic and operational [Goals] of the [Focal Public Administration].

In the [Public Administration Motivation view], only the most important strategic goals are reflected.

Here, the complete set of goals of the [Focal Public Administration] can be detailed, together with the breakdown in subgoals and operational goals.

If the strategy of the [Focal Public Administration] is detailed in one or more internal or external documents, provide links to these documents here.