| |

|

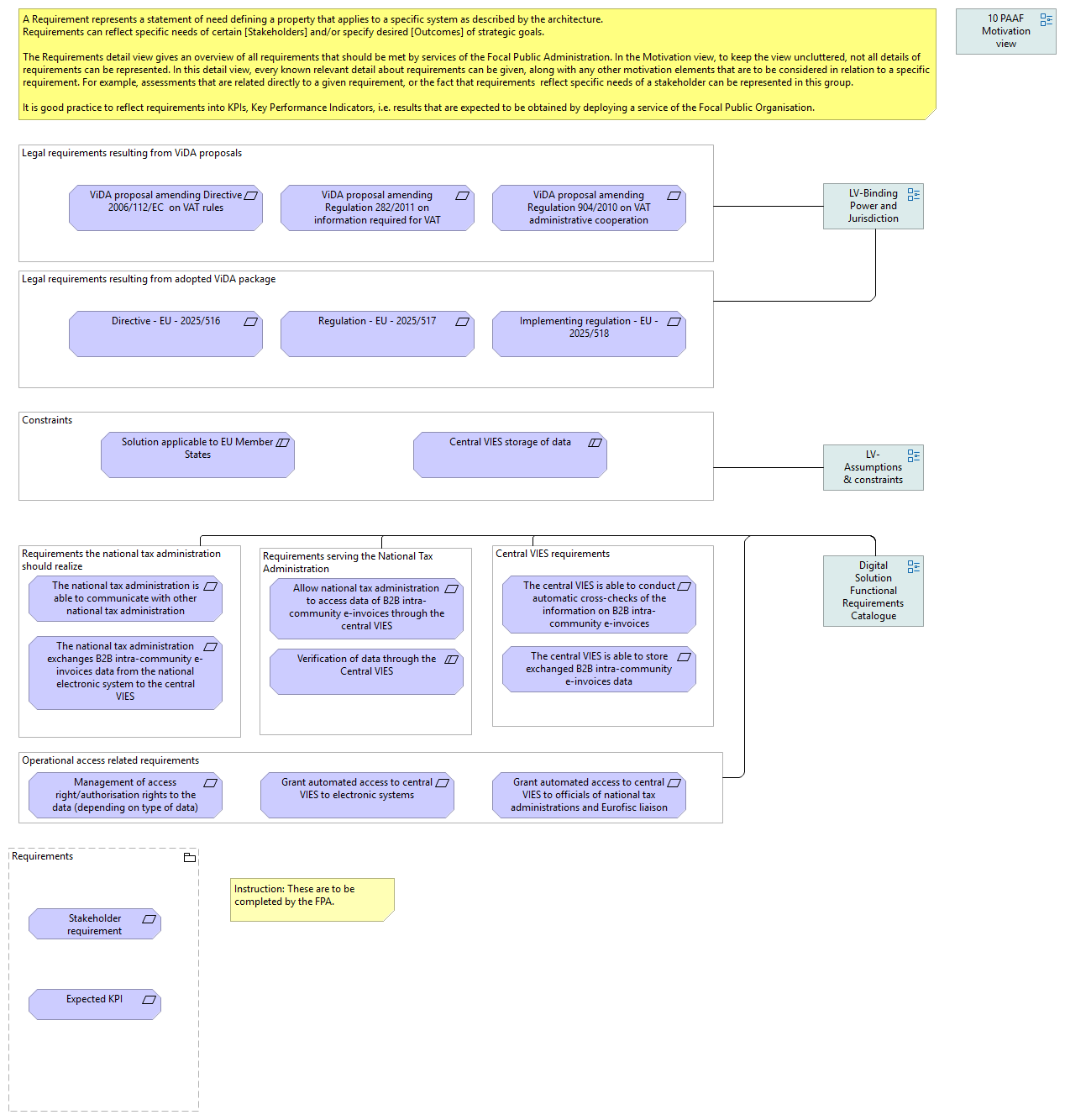

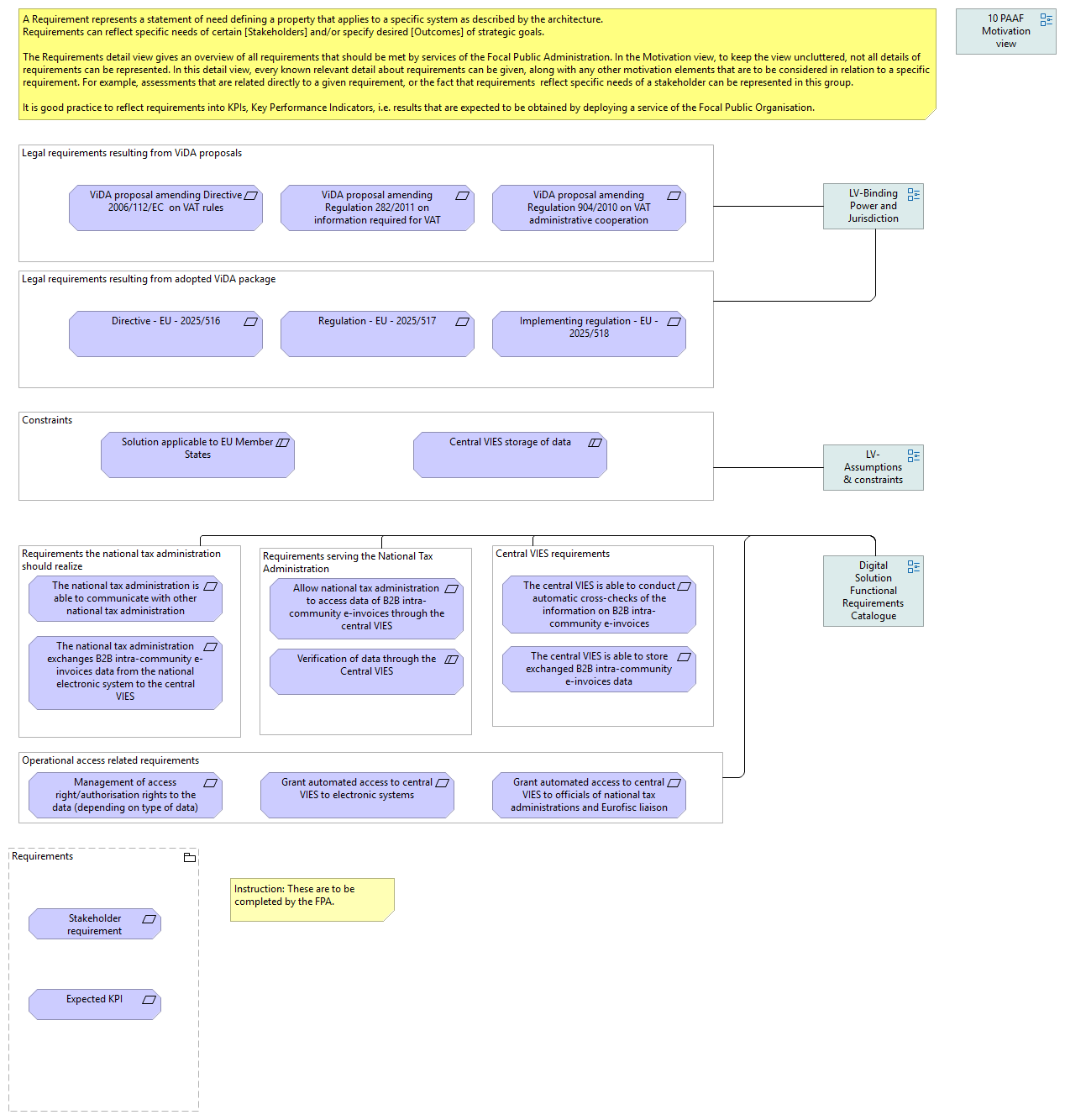

| Requirements |

|

| Stakeholder requirements |

|

| Expected KPI |

|

| Legal requirements resulting from the adopted ViDA package |

|

| Council Directive (EU) 2025/516 of 11 March 2025 amending Directive 2006/112/EC as regards VAT rules for the digital age |

|

| Council Implementing Regulation (EU) 2025/518 of 11 March 2025 amending Implementing Regulation (EU) No 282/2011 as regards information requirements for certain VAT schemes |

|

| Council Regulation (EU) 2025/517 of 11 March 2025 amending Regulation (EU) No 904/2010 as regards the VAT administrative cooperation arrangements needed for the digital age |

|

| Constraints |

|

| Solution applicable to EU Member States |

|

| Central VIES storage of data |

|

| Electronic invoice with Reference European Standard for Electronic invoicing |

|

| Operational access related requirements |

|

| Management of access right/authorisation rights to the data (depending on type of data) |

|

| Grant automated access to central VIES to electronic systems |

|

| Grant automated access to central VIES to officials of national tax administrations and Eurofisc liaison officials |

|

| Requirements the national tax administration should realize |

|

| The national tax administration is able to communicate with other national tax administration |

|

| The national tax administration exchanges B2B intra-community e-invoices data from the national electronic system to the central VIES |

|

| Requirements serving the National Tax Administration |

|

| Allow national tax administration to access data of B2B intra-community e-invoices through the central VIES |

|

| Verification of data through the Central VIES |

|

| Central VIES requirements |

|

| The central VIES is able to conduct automatic cross-checks of the information on B2B intra-community e-invoices |

|

| The central VIES is able to store exchanged B2B intra-community e-invoices data |

|

| LV-Binding Power and Jurisdiction |

|

| LV-Assumptions & constraints |

|

| Digital Solution Functional Requirements Catalogue view |

|

| |

|

| 10 PAAF MS Motivation view |

|

| Regulation 2022/0379 on laying down measures for a high level of public sector interoperability across the Union (Interoperable Europe Act) |

|

| Interoperable Europe Act requirements |

|

| Legal requirements |

|

| Functional requirements |

|

| Technical requirements |

|

| Digital Solution Architecture Decisions Catalogue view |

|

| «rfc» Regulation 2024/903 on laying down measures for a high level of public sector interoperability across the Union (Interoperable Europe Act) |

|