| |

|

VIES HTML Human Interface |

VIES Human Interface |

| |

|

VIES HTML Human Interface |

VIES SingleWindow Service |

| |

|

VIES SingleWindow Service |

VISDRR Digital Solution |

| |

|

VISDRR Digital Solution |

e-invoice Data Transmission |

| |

|

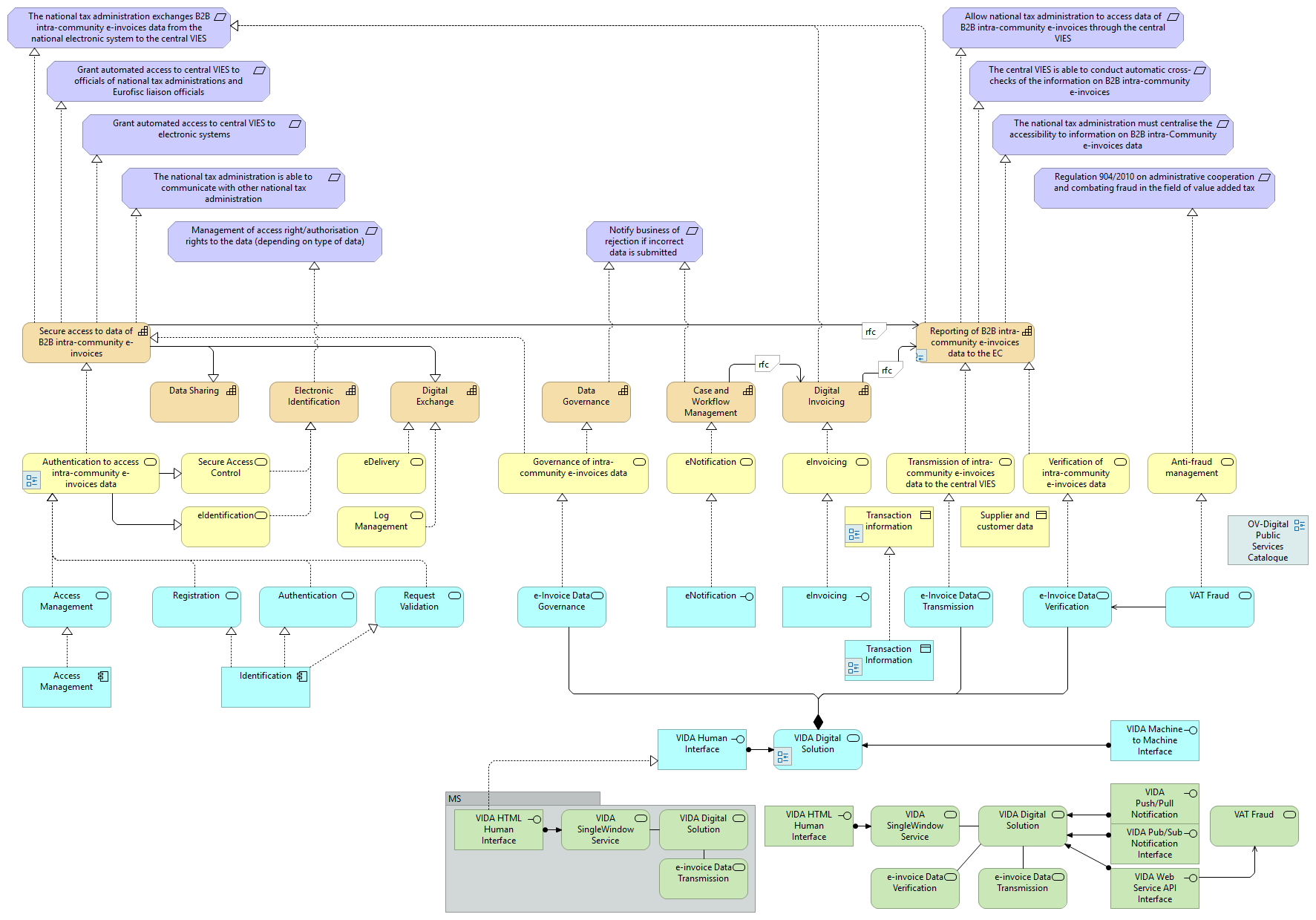

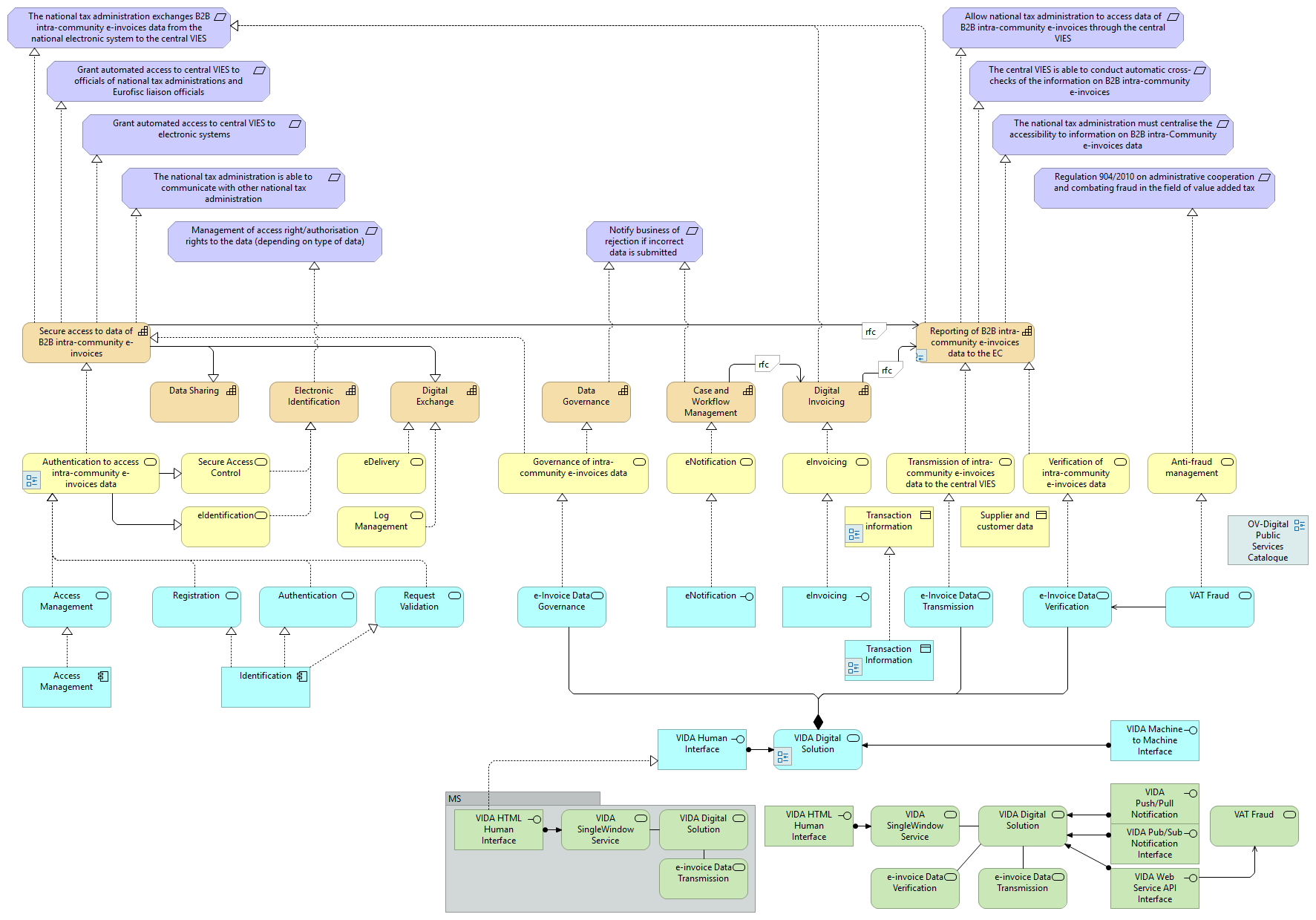

Secure access to data of B2B intra-community e-invoices |

The national tax administration exchanges B2B intra-community e-invoices data from the national electronic system to the central VIES |

| |

|

Secure access to data of B2B intra-community e-invoices |

Grant automated access to central VIES to officials of national tax administrations and Eurofisc liaison officials |

| |

|

Secure access to data of B2B intra-community e-invoices |

Grant automated access to central VIES to electronic systems |

| |

|

Secure access to data of B2B intra-community e-invoices |

The national tax administration is able to communicate with other national tax administration |

| |

|

Secure access to data of B2B intra-community e-invoices |

Data Sharing |

| |

|

Secure access to data of B2B intra-community e-invoices |

Digital Exchange |

| |

|

Secure access to data of B2B intra-community e-invoices |

Reporting of B2B intra-community e-invoices data to the EC |

| |

|

Secure access to data of B2B intra-community e-invoices |

Electronic Identification |

| |

|

Governance of intra-community e-invoices data |

Secure access to data of B2B intra-community e-invoices |

| |

|

Governance of intra-community e-invoices data |

Data Governance |

| |

|

Authentication to access intra-community e-invoices data |

Secure access to data of B2B intra-community e-invoices |

| |

|

Authentication to access intra-community e-invoices data |

Secure Access Control |

| |

|

Authentication to access intra-community e-invoices data |

eIdentification |

| |

|

Secure Access Control |

Electronic Identification |

| |

|

eIdentification |

Electronic Identification |

| |

|

Access Management |

Authentication to access intra-community e-invoices data |

| |

|

Authentication |

Authentication to access intra-community e-invoices data |

| |

|

Request Validation |

Authentication to access intra-community e-invoices data |

| |

|

Registration |

Authentication to access intra-community e-invoices data |

| |

|

Identification |

Authentication |

| |

|

Identification |

Request Validation |

| |

|

Identification |

Registration |

| |

|

Access Management |

Access Management |

| |

|

Electronic Identification |

Management of access right/authorisation rights to the data (depending on type of data) |

| |

|

Data Governance |

Notify business of rejection if incorrect data is submitted |

| |

|

Data Governance |

Case and Workflow Management |

| |

|

Verification of intra-community e-invoices data |

Reporting of B2B intra-community e-invoices data to the EC |

| |

|

Verification of intra-community e-invoices data |

Cross checking of intra-community e-invoices data |

| |

|

Anti-fraud management |

Regulation 904/2010 on administrative cooperation and combating fraud in the field of value added tax |

| |

|

Anti-fraud management |

Fraud detection on intra-community e-invoices data |

| |

|

VAT Fraud detection |

Anti-fraud management |

| |

|

VAT Fraud detection |

e-Invoice Data Verification |

| |

|

VIES Machine to Machine Interface |

VISDRR Digital Solution |

| |

|

VIES Human Interface |

VISDRR Digital Solution |

| |

|

VISDRR Digital Solution |

e-Invoice Data Verification |

| |

|

VISDRR Digital Solution |

e-Invoice Data Governance |

| |

|

VISDRR Digital Solution |

e-Invoice Data Transmission |

| |

|

e-Invoice Data Transmission |

Transmission of intra-community e-invoices data to the central VIES |

| |

|

e-Invoice Data Governance |

Governance of intra-community e-invoices data |

| |

|

e-Invoice Data Verification |

Verification of intra-community e-invoices data |

| |

|

eDelivery |

Digital Exchange |

| |

|

Log Management |

Digital Exchange |

| |

|

Reporting of B2B intra-community e-invoices data to the EC |

The national tax administration must centralise the accessibility to information on B2B intra-Community e-invoices data |

| |

|

Reporting of B2B intra-community e-invoices data to the EC |

The central VIES is able to conduct automatic cross-checks of the information on B2B intra-community e-invoices |

| |

|

Reporting of B2B intra-community e-invoices data to the EC |

Allow national tax administration to access data of B2B intra-community e-invoices through the central VIES |

| |

|

Reporting of B2B intra-community e-invoices data to the EC |

The national tax administration exchanges B2B intra-community e-invoices data from the national electronic system to the central VIES |

| |

|

Transmission of intra-community e-invoices data to the central VIES |

Reporting of B2B intra-community e-invoices data to the EC |

| |

|

Digital Invoicing |

The national tax administration exchanges B2B intra-community e-invoices data from the national electronic system to the central VIES |

| |

|

Digital Invoicing |

Reporting of B2B intra-community e-invoices data to the EC |

| |

|

eInvoicing |

Digital Invoicing |

| |

|

Case and Workflow Management |

Notify business of rejection if incorrect data is submitted |

| |

|

Case and Workflow Management |

Digital Invoicing |

| |

|

eNotification |

Case and Workflow Management |

| |

|

Transaction Information |

Transaction information |

| |

|

VIES HTML Human Interface |

VIES SingleWindow Service |

| |

|

VISDRR Digital Solution |

e-invoice Data Transmission |

| |

|

VISDRR Digital Solution |

e-invoice Data Verification |

| |

|

VIES SingleWindow Service |

VISDRR Digital Solution |

| |

|

VIES Push/Pull Notification Interface |

VISDRR Digital Solution |

| |

|

VIES Web Service API Interface |

VISDRR Digital Solution |

| |

|

VIES Web Service API Interface |

VAT Fraud detection |

| |

|

VIES Pub/Sub Notification Interface |

VISDRR Digital Solution |

| |

|

VAT Fraud detection |

VAT Fraud detection |

| |

|

Fraud detection on intra-community e-invoices data |

Regulation 904/2010 on administrative cooperation and combating fraud in the field of value added tax |

| |

|

Cross checking of intra-community e-invoices data |

Regulation 904/2010 on administrative cooperation and combating fraud in the field of value added tax |

| |

|

eInvoicing |

eInvoicing |

| |

|

eNotification |

eNotification |