| |

|

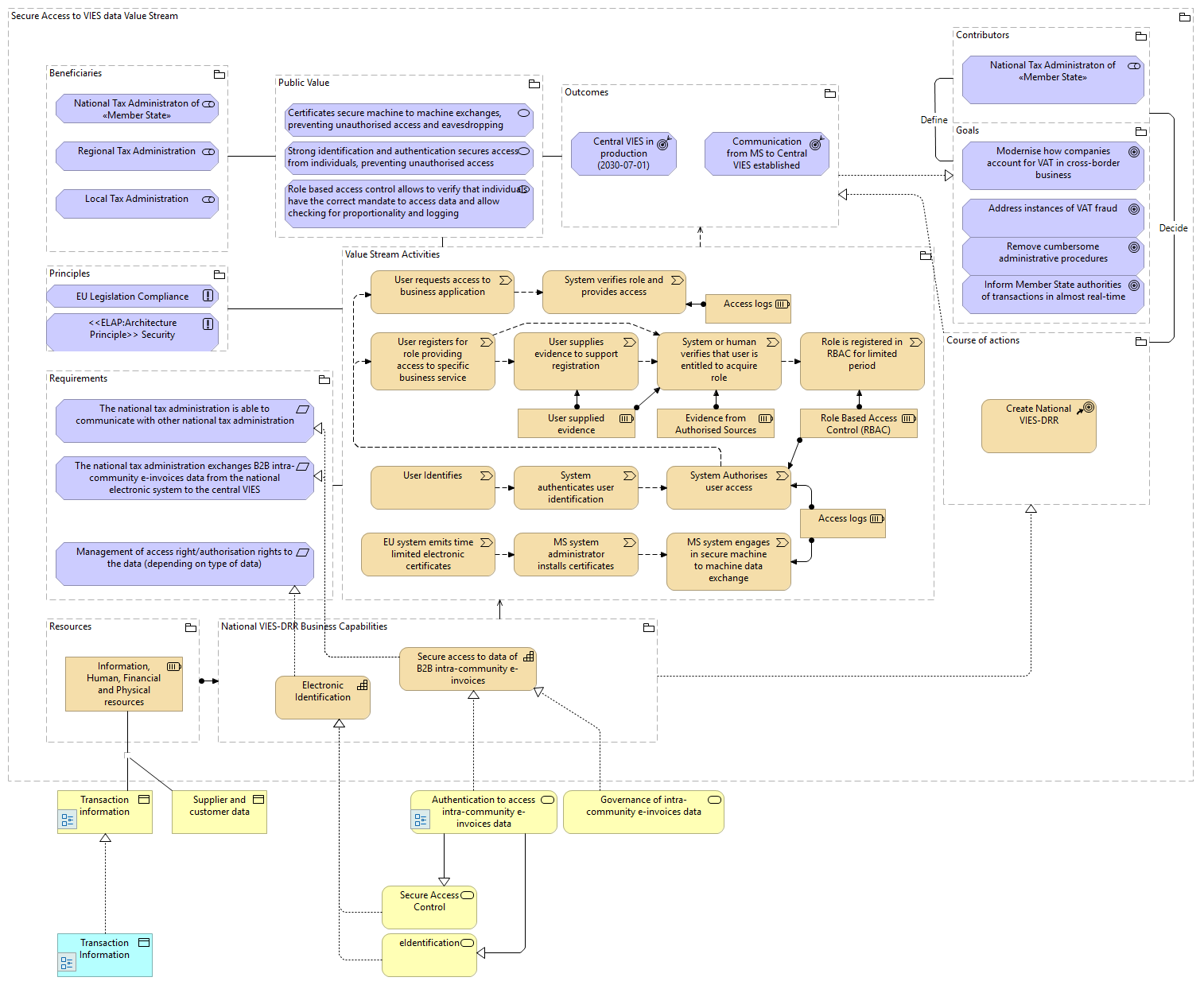

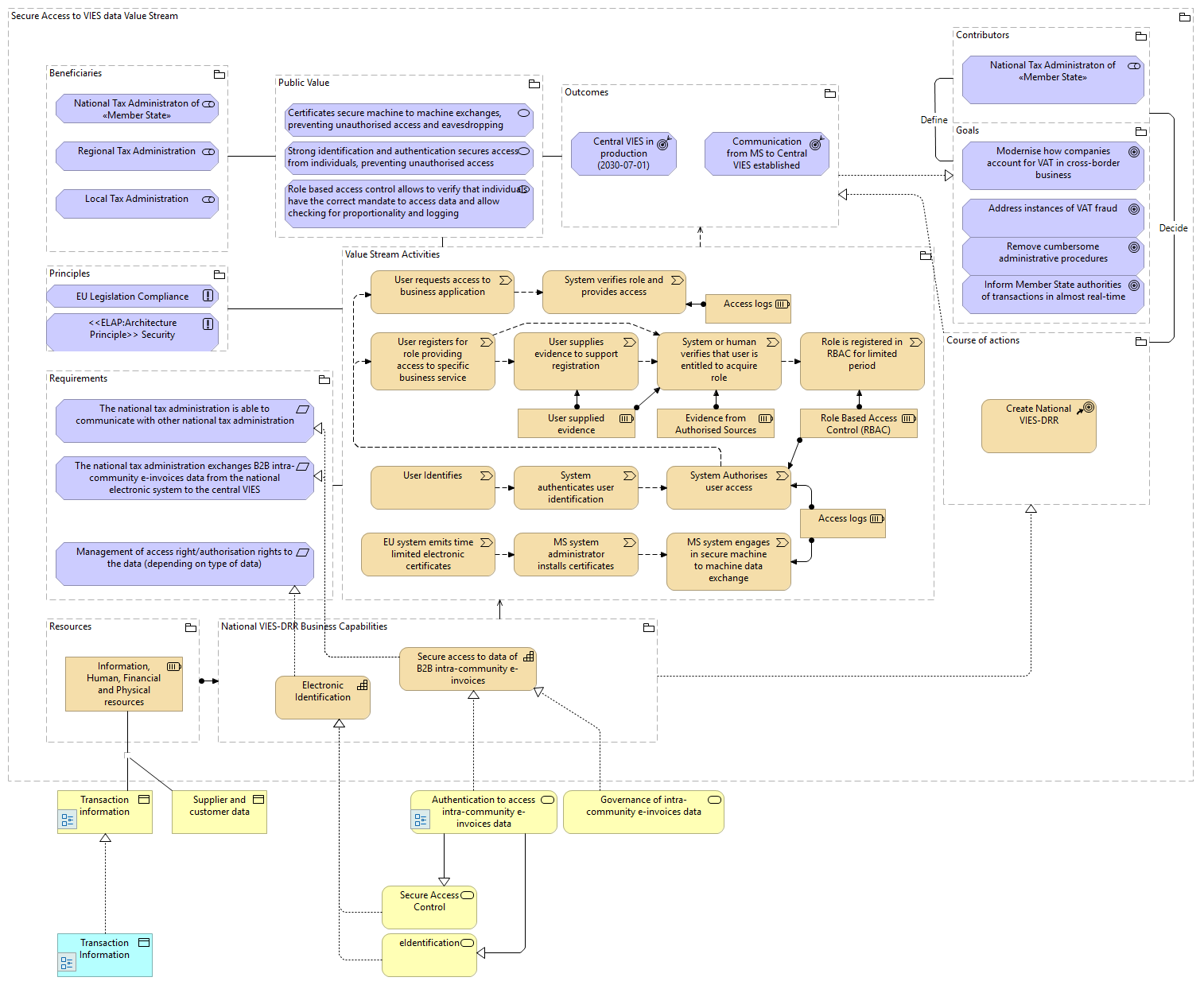

Secure Access to VIES data Value Stream |

Goals |

| |

|

Secure Access to VIES data Value Stream |

Course of actions |

| |

|

Secure Access to VIES data Value Stream |

Value Stream Activities |

| |

|

Secure Access to VIES data Value Stream |

National VIES-DRR Business Capabilities |

| |

|

Secure Access to VIES data Value Stream |

Contributors |

| |

|

Secure Access to VIES data Value Stream |

Resources |

| |

|

Secure Access to VIES data Value Stream |

Principles |

| |

|

Secure Access to VIES data Value Stream |

Requirements |

| |

|

Secure Access to VIES data Value Stream |

Public Value |

| |

|

Secure Access to VIES data Value Stream |

Outcomes |

| |

|

Secure Access to VIES data Value Stream |

Beneficiaries |

| |

|

Requirements |

Value Stream Activities |

| |

|

Requirements |

Management of access right/authorisation rights to the data (depending on type of data) |

| |

|

Requirements |

The national tax administration exchanges B2B intra-community e-invoices data from the national electronic system to the central VIES |

| |

|

Requirements |

The national tax administration is able to communicate with other national tax administration |

| |

|

Principles |

Value Stream Activities |

| |

|

Principles |

EU Legislation Compliance |

| |

|

Principles |

<<ELAP:Architecture Principle>> Security |

| |

|

Resources |

National VIES-DRR Business Capabilities |

| |

|

Resources |

Information, Human, Financial and Physical resources |

| |

|

National VIES-DRR Business Capabilities |

Course of actions |

| |

|

National VIES-DRR Business Capabilities |

Value Stream Activities |

| |

|

National VIES-DRR Business Capabilities |

Secure access to data of B2B intra-community e-invoices |

| |

|

National VIES-DRR Business Capabilities |

Electronic Identification |

| |

|

Secure access to data of B2B intra-community e-invoices |

The national tax administration is able to communicate with other national tax administration |

| |

|

Secure access to data of B2B intra-community e-invoices |

The national tax administration exchanges B2B intra-community e-invoices data from the national electronic system to the central VIES |

| |

|

Electronic Identification |

Management of access right/authorisation rights to the data (depending on type of data) |

| |

|

Value Stream Activities |

Outcomes |

| |

|

Value Stream Activities |

Public Value |

| |

|

Value Stream Activities |

User Identifies |

| |

|

Value Stream Activities |

System authenticates user identification |

| |

|

Value Stream Activities |

System Authorises user access |

| |

|

Value Stream Activities |

User registers for role providing access to specific business service |

| |

|

Value Stream Activities |

System or human verifies that user is entitled to acquire role |

| |

|

Value Stream Activities |

User supplies evidence to support registration |

| |

|

Value Stream Activities |

Role is registered in RBAC for limited period |

| |

|

Value Stream Activities |

User supplied evidence |

| |

|

Value Stream Activities |

Evidence from Authorised Sources |

| |

|

Value Stream Activities |

Role Based Access Control (RBAC) data |

| |

|

Value Stream Activities |

User requests access to business application |

| |

|

Value Stream Activities |

System verifies role and provides access |

| |

|

Value Stream Activities |

EU system emits time limited electronic certificates |

| |

|

Value Stream Activities |

MS system administrator installs certificates on MS systems |

| |

|

Value Stream Activities |

MS system engages in secure machine to machine data exchange |

| |

|

Value Stream Activities |

Access logs |

| |

|

Value Stream Activities |

Access logs |

| |

|

User Identifies |

System authenticates user identification |

| |

|

System authenticates user identification |

System Authorises user access |

| |

|

System Authorises user access |

User registers for role providing access to specific business service |

| |

|

System Authorises user access |

User requests access to business application |

| |

|

User registers for role providing access to specific business service |

User supplies evidence to support registration |

| |

|

User registers for role providing access to specific business service |

System or human verifies that user is entitled to acquire role |

| |

|

System or human verifies that user is entitled to acquire role |

Role is registered in RBAC for limited period |

| |

|

User supplies evidence to support registration |

System or human verifies that user is entitled to acquire role |

| |

|

User supplied evidence |

User supplies evidence to support registration |

| |

|

User supplied evidence |

System or human verifies that user is entitled to acquire role |

| |

|

Evidence from Authorised Sources |

System or human verifies that user is entitled to acquire role |

| |

|

Role Based Access Control (RBAC) data |

Role is registered in RBAC for limited period |

| |

|

Role Based Access Control (RBAC) data |

System Authorises user access |

| |

|

User requests access to business application |

System verifies role and provides access |

| |

|

EU system emits time limited electronic certificates |

MS system administrator installs certificates on MS systems |

| |

|

MS system administrator installs certificates on MS systems |

MS system engages in secure machine to machine data exchange |

| |

|

Access logs |

System Authorises user access |

| |

|

Access logs |

MS system engages in secure machine to machine data exchange |

| |

|

Access logs |

System verifies role and provides access |

| |

|

Public Value |

Outcomes |

| |

|

Public Value |

Certificates secure machine to machine exchanges, preventing unauthorised access and eavesdropping |

| |

|

Public Value |

Strong identification and authentication secures access from individuals, preventing unauthorised access |

| |

|

Public Value |

Role based access control allows to verify that individuals have the correct mandate to access data and allow checking for proportionality and logging |

| |

|

Beneficiaries |

Public Value |

| |

|

Beneficiaries |

National Tax Administraton of «Member State» |

| |

|

Outcomes |

Goals |

| |

|

Outcomes |

Communication from MS to Central VIES established |

| |

|

Outcomes |

Central VIES in production (2030-07-01) |

| Decide |

|

Contributors |

Course of actions |

| Define |

|

Contributors |

Goals |

| |

|

Contributors |

National Tax Administraton of «Member State» |

| |

|

Goals |

Inform Member State authorities of transactions in almost real-time |

| |

|

Goals |

Remove cumbersome administrative procedures |

| |

|

Goals |

Address instances of VAT fraud |

| |

|

Goals |

Modernise how companies account for VAT in cross-border business |

| |

|

Course of actions |

Outcomes |

| |

|

Course of actions |

Create National VIES-DRR |

| |

|

Transaction Information |

Transaction information |

| |

|

Governance of intra-community e-invoices data |

Secure access to data of B2B intra-community e-invoices |

| |

|

Authentication to access intra-community e-invoices data |

Secure Access Control |

| |

|

Authentication to access intra-community e-invoices data |

Secure access to data of B2B intra-community e-invoices |

| |

|

Authentication to access intra-community e-invoices data |

eIdentification |

| |

|

Secure Access Control |

Electronic Identification |

| |

|

eIdentification |

Electronic Identification |