| |

|

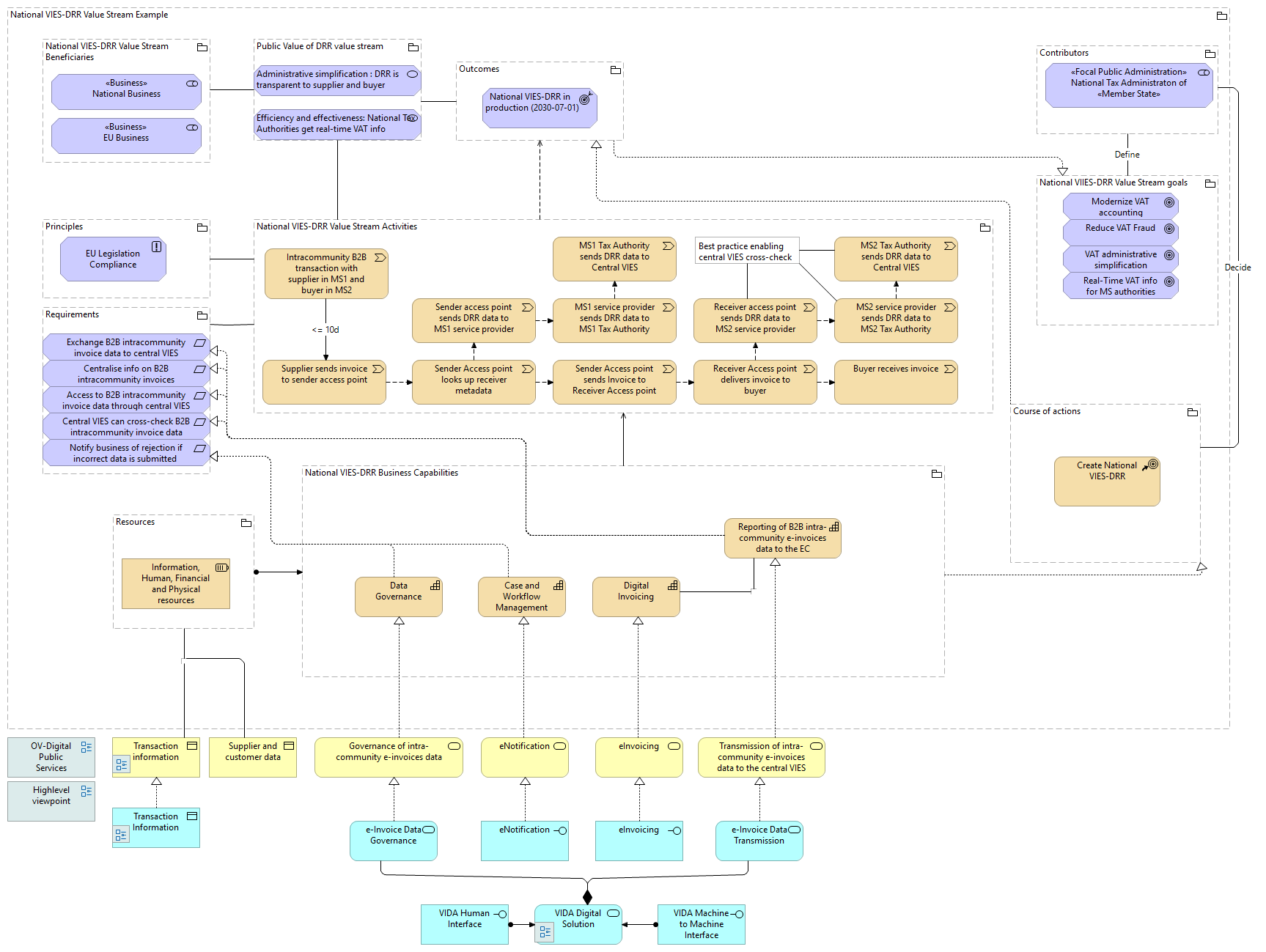

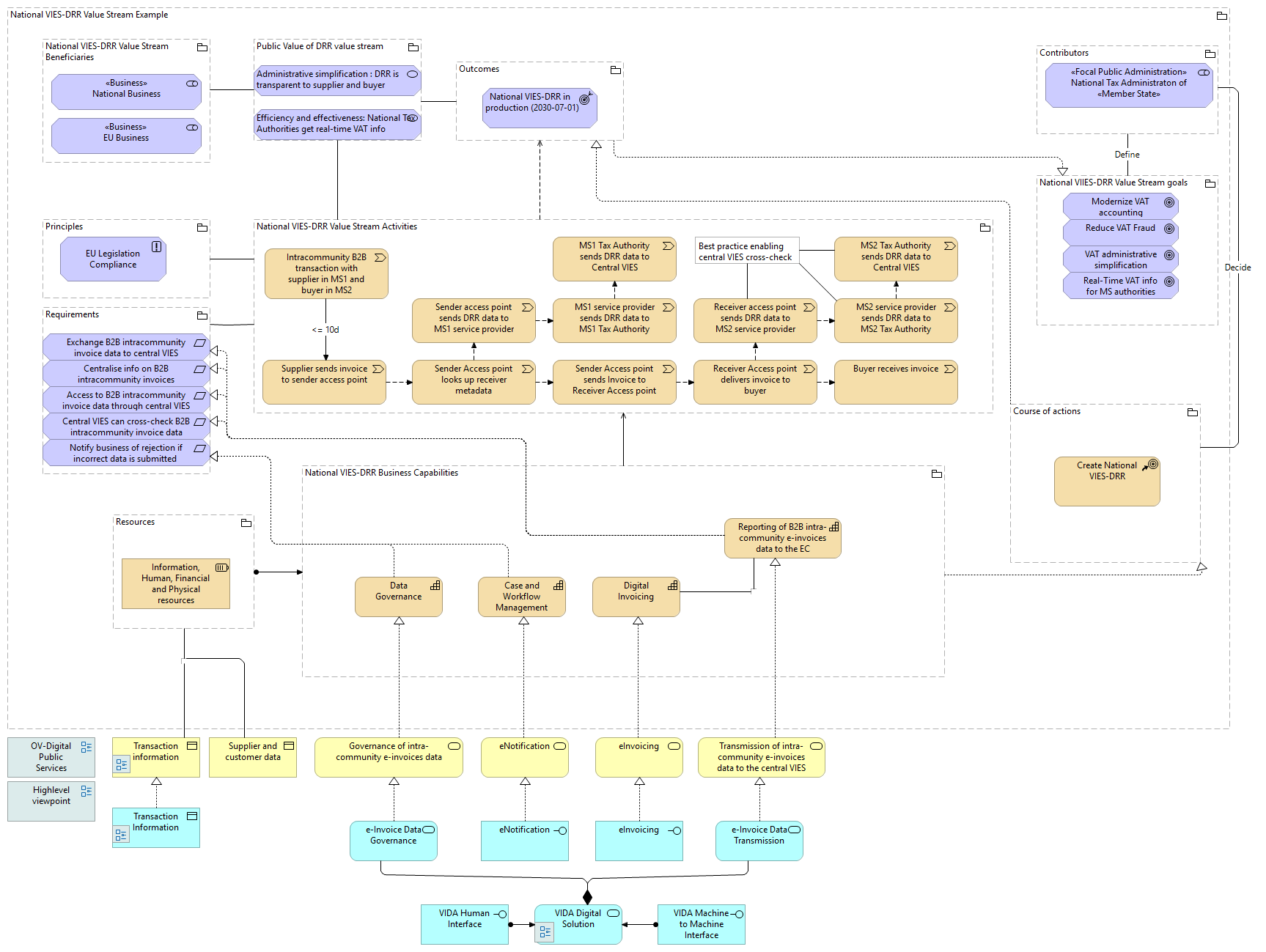

National VIES-DRR Value Stream Example |

National VIES-DRR Value Stream Activities |

| |

|

National VIES-DRR Value Stream Example |

Resources |

| |

|

National VIES-DRR Value Stream Example |

National VIES-DRR Value Stream Beneficiaries |

| |

|

National VIES-DRR Value Stream Example |

Course of actions |

| |

|

National VIES-DRR Value Stream Example |

National VIIES-DRR Value Stream goals |

| |

|

National VIES-DRR Value Stream Example |

Outcomes |

| |

|

National VIES-DRR Value Stream Example |

Requirements |

| |

|

National VIES-DRR Value Stream Example |

Contributors |

| |

|

National VIES-DRR Value Stream Example |

Public Value of DRR value stream |

| |

|

National VIES-DRR Value Stream Example |

Principles |

| |

|

National VIES-DRR Value Stream Example |

National VIES-DRR Business Capabilities |

| |

|

Requirements |

National VIES-DRR Value Stream Activities |

| |

|

Requirements |

Allow national tax administration to access data of B2B intra-community e-invoices through the central VIES |

| |

|

Requirements |

The national tax administration exchanges B2B intra-community e-invoices data from the national electronic system to the central VIES |

| |

|

Requirements |

The central VIES is able to conduct automatic cross-checks of the information on B2B intra-community e-invoices |

| |

|

Requirements |

The national tax administration must centralise the accessibility to information on B2B intra-Community e-invoices data |

| |

|

Requirements |

Notify business of rejection if incorrect data is submitted |

| |

|

Principles |

National VIES-DRR Value Stream Activities |

| |

|

Principles |

EU Legislation Compliance |

| |

|

Resources |

Information, Human, Financial and Physical resources |

| |

|

Resources |

National VIES-DRR Business Capabilities |

| |

|

National VIES-DRR Business Capabilities |

Reporting of B2B intra-community e-invoices data to the EC |

| |

|

National VIES-DRR Business Capabilities |

National VIES-DRR Value Stream Activities |

| |

|

National VIES-DRR Business Capabilities |

Course of actions |

| |

|

National VIES-DRR Business Capabilities |

Data Governance |

| |

|

National VIES-DRR Business Capabilities |

Case and Workflow Management |

| |

|

National VIES-DRR Business Capabilities |

Digital Invoicing |

| |

|

National VIES-DRR Business Capabilities |

Secure access to data of B2B intra-community e-invoices |

| |

|

Reporting of B2B intra-community e-invoices data to the EC |

The national tax administration must centralise the accessibility to information on B2B intra-Community e-invoices data |

| |

|

Reporting of B2B intra-community e-invoices data to the EC |

The national tax administration exchanges B2B intra-community e-invoices data from the national electronic system to the central VIES |

| |

|

Reporting of B2B intra-community e-invoices data to the EC |

The central VIES is able to conduct automatic cross-checks of the information on B2B intra-community e-invoices |

| |

|

Reporting of B2B intra-community e-invoices data to the EC |

Allow national tax administration to access data of B2B intra-community e-invoices through the central VIES |

| |

|

Case and Workflow Management |

Notify business of rejection if incorrect data is submitted |

| |

|

Digital Invoicing |

Reporting of B2B intra-community e-invoices data to the EC |

| |

|

Data Governance |

Notify business of rejection if incorrect data is submitted |

| |

|

Secure access to data of B2B intra-community e-invoices |

Reporting of B2B intra-community e-invoices data to the EC |

| |

|

National VIES-DRR Value Stream Activities |

Intracommunity B2B transaction with supplier in MS1 and buyer in MS2 |

| |

|

National VIES-DRR Value Stream Activities |

MS2 Tax Authority sends DRR data to Central VIES |

| |

|

National VIES-DRR Value Stream Activities |

MS1 Tax Authority sends DRR data to Central VIES |

| |

|

National VIES-DRR Value Stream Activities |

MS2 service provider sends DRR data to MS2 Tax Authority |

| |

|

National VIES-DRR Value Stream Activities |

Receiver access point sends DRR data to MS2 service provider |

| |

|

National VIES-DRR Value Stream Activities |

MS1 service provider sends DRR data to MS1 Tax Authority |

| |

|

National VIES-DRR Value Stream Activities |

Sender access point sends DRR data to MS1 service provider |

| |

|

National VIES-DRR Value Stream Activities |

Buyer receives invoice |

| |

|

National VIES-DRR Value Stream Activities |

Receiver Access point delivers invoice to buyer |

| |

|

National VIES-DRR Value Stream Activities |

Sender Access point sends Invoice to Receiver Access point |

| |

|

National VIES-DRR Value Stream Activities |

Supplier sends invoice to sender access point |

| |

|

National VIES-DRR Value Stream Activities |

Sender Access point looks up receiver metadata |

| |

|

National VIES-DRR Value Stream Activities |

Outcomes |

| |

|

National VIES-DRR Value Stream Activities |

Public Value of DRR value stream |

| |

|

Sender Access point looks up receiver metadata |

Sender Access point sends Invoice to Receiver Access point |

| |

|

Sender Access point looks up receiver metadata |

Sender access point sends DRR data to MS1 service provider |

| |

|

Supplier sends invoice to sender access point |

Sender Access point looks up receiver metadata |

| |

|

Sender Access point sends Invoice to Receiver Access point |

Receiver Access point delivers invoice to buyer |

| |

|

Receiver Access point delivers invoice to buyer |

Receiver access point sends DRR data to MS2 service provider |

| |

|

Receiver Access point delivers invoice to buyer |

Buyer receives invoice |

| |

|

Sender access point sends DRR data to MS1 service provider |

MS1 service provider sends DRR data to MS1 Tax Authority |

| |

|

MS1 service provider sends DRR data to MS1 Tax Authority |

MS1 Tax Authority sends DRR data to Central VIES |

| |

|

Receiver access point sends DRR data to MS2 service provider |

MS2 service provider sends DRR data to MS2 Tax Authority |

| |

|

MS2 service provider sends DRR data to MS2 Tax Authority |

MS2 Tax Authority sends DRR data to Central VIES |

| <= 10d |

|

Intracommunity B2B transaction with supplier in MS1 and buyer in MS2 |

Supplier sends invoice to sender access point |

| |

|

Public Value of DRR value stream |

Outcomes |

| |

|

Public Value of DRR value stream |

Efficiency and effectiveness: National Tax Authorities get real-time VAT info |

| |

|

Public Value of DRR value stream |

Administrative simplification : DRR is transparent to supplier and buyer |

| |

|

National VIES-DRR Value Stream Beneficiaries |

EU Business |

| |

|

National VIES-DRR Value Stream Beneficiaries |

National Business |

| |

|

National VIES-DRR Value Stream Beneficiaries |

Public Value of DRR value stream |

| |

|

Outcomes |

National VIIES-DRR Value Stream goals |

| |

|

Outcomes |

Central VIES in production (2030-07-01) |

| |

|

Outcomes |

Communication from MS to Central VIES established |

| |

|

Contributors |

National Tax Administraton of «Member State» |

| Decide |

|

Contributors |

Course of actions |

| Define |

|

Contributors |

National VIIES-DRR Value Stream goals |

| |

|

National VIIES-DRR Value Stream goals |

Modernise how companies account for VAT in cross-border business |

| |

|

National VIIES-DRR Value Stream goals |

Remove cumbersome administrative procedures |

| |

|

National VIIES-DRR Value Stream goals |

Inform Member State authorities of transactions in almost real-time |

| |

|

National VIIES-DRR Value Stream goals |

Address instances of VAT fraud |

| |

|

Course of actions |

Create National VIES-DRR |

| |

|

Course of actions |

Outcomes |

| |

|

Governance of intra-community e-invoices data |

Data Governance |

| |

|

VIES Machine to Machine Interface |

VISDRR Digital Solution |

| |

|

VIES Human Interface |

VISDRR Digital Solution |

| |

|

VISDRR Digital Solution |

e-Invoice Data Transmission |

| |

|

VISDRR Digital Solution |

e-Invoice Data Governance |

| |

|

e-Invoice Data Transmission |

Transmission of intra-community e-invoices data to the central VIES |

| |

|

e-Invoice Data Governance |

Governance of intra-community e-invoices data |

| |

|

Transmission of intra-community e-invoices data to the central VIES |

Reporting of B2B intra-community e-invoices data to the EC |

| |

|

eInvoicing |

Digital Invoicing |

| |

|

eNotification |

Case and Workflow Management |

| |

|

Transaction Information |

Transaction information |

| |

|

eNotification |

eNotification |

| |

|

eInvoicing |

eInvoicing |